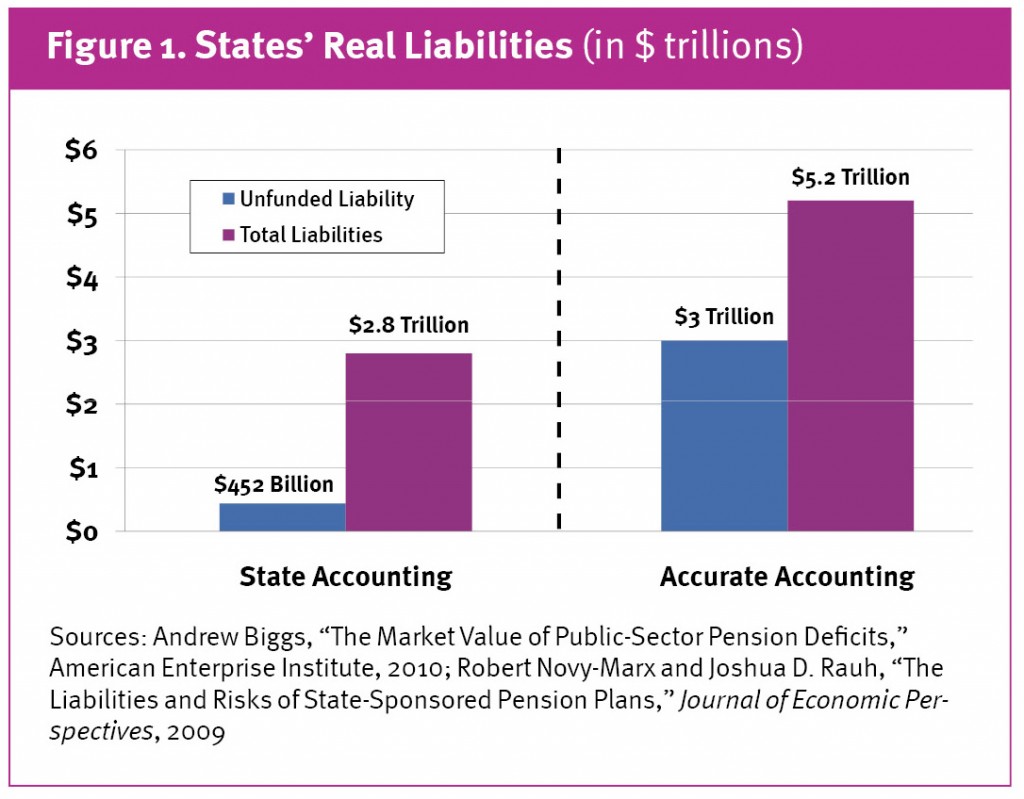

Over at Reason Magazine, Veronique de Rugy illuminates the State Pension problem by drawing attention to the differences in accounting rules applied by the market and the government.

As de Rugy notes, states are not required to pony up regular contributions to pension systems and they systematically underestimate the liabilities in pension funds.

State officials not only failed to set aside sufficient money to fund future benefits, but they also illogically assumed that the riskier the investment, the better funded the plan would be.

One of the most important aspects De Rugy raises is that much of these unfunded liabilities exist off the books as a result of these poor accounted practices. This means that the debt crises in many states are dramatically underestimated. For example:

[Connecticut�s] reported debt is roughly $23 billion. The estimated value of its unfunded pension liabilities is $48.4 billion. To that amount we should add another $28.2 billion in underestimated liabilities due to poor accounting standards.

For a related study from Eileen Norcross, see here.